BUSINESS CREDIT & FUNDING PLATFORM

Business Report Monitoring

STEP 4.2 – MONITOR DUN & BRADSTREET

PROGRAM MENU

➡ MODULE 1 - BUSINESS CREDIBILITY

• Step 1.1 Business Name

• Step 1.2 Business Address

• Step 1.3 Business Entity

• Step 1.4 EIN#

• Step 1.5 Business Phone # & 411

• Step 1.6 Business Email

• Step 1.7 Business Licence

• Step 1.8 Business Bank Account

• Step 1.9 Business Merchant Account

• Step 1.10 Wrap Up

➡ MODULE 2 – ESTABLISH BUSINESS REPORT

• Step 2.1 Dun & Bradstreet

• Step 2.2 Experian Business

• Step 2.3 Equifax Business

• Step 2.4 Reporting- How to Fix Business Credit

➡ MODULE 3 – START BUILDING: TIER 1

• Step 3.1 Start Building: Tier 1

➡ MODULE 4 – BUSINESS REPORT MONITORING

• Step 4.1 Credit Monitoring

• Step 4.2 Monitor Dun & Bradstreet

• Step 4.3 Monitor Experian Business

• Step 4.4 Monitor Equifax Business

• Step 4.5 Request Lexis Nexis report

• Step 4.6 Request Chex Systems Report

➡ MODULE 5- BUILDING CREDIT: TIER2

• Step 5.1 Building Credit: Tier2

➡ MODULE 6 – ADVANCED BUILDING: TIER 3

• Step 6.1 Advanced Building: Tier 3

OVERVIEW

Just as it is important for an individual to understand their personal credit reports, it is important for businesses to understand what is on their business credit report. Every business credit bureau has their own scoring models and monitoring service. Brush up on your skills and read your D & B report. Be proactive; identify what your goals are with your business credit reports. Do you want to get more financing in the future? Get higher credit limits?

IS YOUR BUSINESS MONITORING ITS DUN & BRADSTREET (D & B) REPORT?

MONITOR D & B REPORT

Every business credit bureau has their own monitoring and scoring models. It’s important to monitor your business credit reports regularly so you are aware of any changes that could impact your business. Monitoring business credit is different than monitoring personal credit reports.

To monitor your D & B report there are 2 strong options:

1) Directly with D & B (Most expensive option but most comprehensive report)

2) Integrated NAV monitoring (Least expensive, not as comprehensive but enough data)

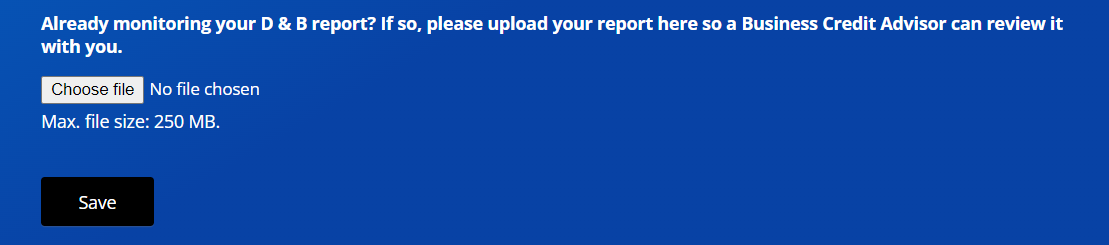

Need to set up D & B business credit report monitoring?

RESOURCES

We hope you love the products and services we recommend! We research and update these on a regular basis. Just so you know, we may receive a commission from links on this page. We are diligent to ensure any compensation we receive does not affect the price or level of service offered to you.

COST:Monthly Free

THE CONTENT OF THIS RESOURCES SECTION IS RESTRICTED.

PLEASE SIGN UP TO GET ACCESS!!

VIDEO TRANSCRIPT

It’s important to monitor your business credit.

Empower yourself…know how to ready your d & b report

What are you looking for?

Accuracy

Late payments

All credit is reporting

Other filings including UCC, Liens, Judgments & Bankruptcies

Use this information to build your business credit strategically

First, sign up for d & b credit monitoring. For more detail on which monitoring package to select, please review the D & B credit monitoring segment.

Once you have monitoring log in and view your most recent d & b report.

Its time to dissect the D & B business credit report

Business Credibility

The first item that defines credibility on your business credit report is your business information.

You can see the business name and address listed first. Make sure the name and address are correct. Then you move down to see the business telephone, chief executive; year started, some employees, financial statement date, state finance data, SIC Code & Line of business.

As we scroll down to History & operations, you find the date the information was reported, officers, the year the business was started and the percent of stock ownership. You can also see a short resume of each officer.

Next, they list any affiliate relationships under Corporate Family. This names business’s that are directly affiliated, typically those owned by the same officers.

The business registration section outlines the information found on your business entity secretary of state filing including entity type, date incorporated, state, filing date, shares and so on.

The next section outlines operations, general description, additional phone numbers, employees, facilities, location, and branches.

Lastly, you can see your SIC & NAICS. The number identifies your general business industry.

Paydex Score

You can see your 12 month D & B Paydex score.

Business credit is different than personal credit. Your score with D & B simply defines whether you pay your bills on time.

On the paydex section of your d & b report, you see both your three month & 12-month d & b paydex scores.

Then the report compares your business paydex score to other businesses within your industry.

Next is a graph mapping your paydex score per month

The next section compares your paydex to the industry in more detail including quarters.

You can also see your payment habits comparing the amount of credit extended, the number of payment experiences and percent of payments within terms.

The last portion outlines your payment summary.

Business Credit agencies don’t list the actual creditor that is reporting but does list the general description of the creditor reporting. For example “custom programming” could be John’s Programming shop. You can see the # of payment experiences received, dollar amount, highest credit and the % of payments paid within terms. Just like personal credit the d & b report defines how far beyond terms the payment was paid including 30, 60, 90 and so on.

Next, you get the payment details. The section above generally lists who is reporting, and the payment details breaks out each payment. You can see the amount that is late and the terms that were agreed to.

Credit Score Class Summary

This score predicts the likelihood of a firm paying severely delinquent, beyond 90 days.

First, the business is assigned a class then a credit score percentile. These are calculated based on the businesses payment history compared to industry standard.

Financial Stress Summary

This predicts the likelihood of a firm ceasing business without paying creditors or looking for aid.

Then the businesses financial stress class is compared to other businesses within the industry.

D & B viability rating identifies how likely it is that the business will fail within the next 12 months and then compares the business against like companies in the same industry.

Public Filings

This section outlines all Bankruptcies, judgments, liens, suits & UCC’s.

Each outlines the type of filing, status, identifier, type, dates, and lists the parties involved.

Negative items whether settled or not can hurt the businesses credibility. A UCC isn’t typically a negative item. It is a way for lenders to essentially title equipment and other items taken as collateral. This way lenders are conveying to each other what financing has taken place and the collateral that has been utilized.

Banking & Finance

This is the last section of the D & B credit report. Keep in mind that it isn’t mandatory that a business submits financial information to d & b. We recommend that you don’t supply the data unless you have strong financials that you would like placed on your business credit report.

D & B may make it seem like this financial data has to be submitted.

If financials are submitted d & b summarizes the data listing assets, liabilities, ratios, working capital, net worth & net profit.

This concludes the reading your d & b report segment.

MONITOR WITH NAV

Click mouse jiggler

D&B CREDIT MONITOR BUILDER